After several exceptional years, 2023 saw a sharp slowdown in the property transactions market.

Despite the confinements, the transaction market had reached 1,024,000 sales in 2020. This record was broken in 2021, when 1,170,000 sales were recorded. In 2022, this figure was almost equalled, with 1,130,000 sales. At the end of 2022, however, the market began to slow as interest rates began to rise.

And in 2023, the number of sales is expected to fall below 900,000, representing a 21% year-on-year fall in volume.

There are several factors behind this collapse in the property market, and 2 in particular: rising interest rates and rising prices.

The war in Ukraine triggered a global inflationary phase, with food prices particularly high, and a rise in interest rates. The "easy money" policy that prevailed during the COVID crisis undoubtedly also had an effect on the resurgence of inflation.

Central banks then raised their interest rates with the aim of slowing global economic activity and halting inflation.

While property interest rates were flirting with 1% until January 2022, they have since risen sharply to exceed 4.50% in November 2023.

The impact of this increase is enormous, as you can see from the table: the monthly instalment on a €200,000 20-year loan rises from €920 to €1,265, i.e. an increase of 37.5%.

|

20-year loan of €200,000 |

1% rate |

4.5% rate |

| Monthly payment |

920 € per month |

1,265 per month |

To maintain the same monthly repayment of €920, it is now possible to borrow only €145,400, i.e. a reduction in debt capacity of 27.3%.

| Monthly payment |

920 € per month |

920 € per month |

|

Amount borrowed over 20 years |

200 000 € |

145 400 € |

It is always difficult to make forecasts in a global environment that can change very quickly.

Inflation is slowing and is likely to fall back below 2% during the year. In this situation, the European Central Bank is likely to lower interest rates gradually to stimulate the economy. This measure is unlikely to have any appreciable effect on borrowers before the end of 2024.

At the start of 2024, mortgage rates have fallen slightly (with an average rate of 4.10% over 20 years) and banks seem to be a little less restrictive. But this improvement is only slight, as 58% of French people are convinced that banks would reject their mortgage applications today, which is putting the brakes on any plans to buy a property.

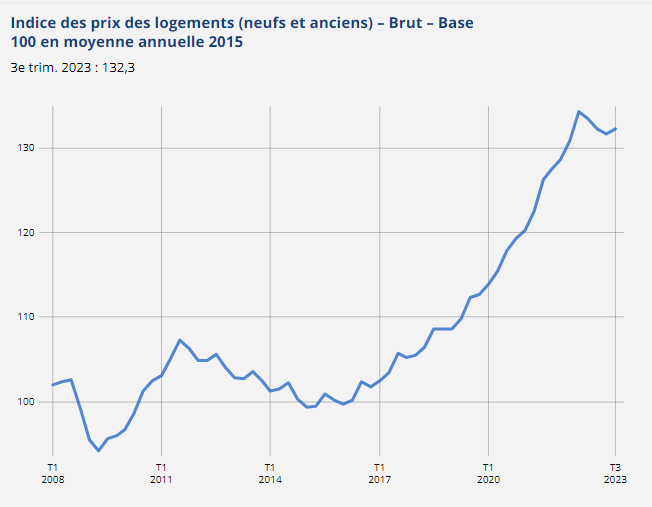

According to INSEE, property prices have risen by more than 30% since the first quarter of 2015.

This average increase conceals very significant disparities between cities. Between 2010 and 2020 (source https://www.notaires.fr/fr/immobilier-fiscalite/prix-et-tendances-de-limmobilier/les-notes-de-conjoncture-immobiliere ),

prices have risen by :

Conversely, prices in Saint-Etienne fell by 25% over the same period, and by 6% in Toulon.

Price trends outside the major cities vary considerably from region to region. Overall, there has been a sharp rise in prices in highly sought-after coastal areas, particularly since the Covid crisis.

Prices have already started to fall: -1% on flat prices, -0.6% on the price of old houses between the 1st and 2nd quarters of 2023.  In fact, the decline is greater in the Paris region than in other regions.

In fact, the decline is greater in the Paris region than in other regions.

The downward trend is likely to continue throughout 2024, and could reach 20% in some areas.

Except in areas where the market is structurally and strongly imbalanced between sellers and buyers.

But the expected fall in prices will probably not be enough to halt the sharp fall in the number of transactions. According to various surveys and property portal statistics, intentions to buy a property are falling sharply.

The year 2023 saw a fall in the number of sales and starts of new homes by property developers. There are several reasons for these difficulties: rising land prices, increased construction costs linked to building standards, and inflation in materials and wages.

The French property developers' federation estimates that sales to individuals in 2023 will be 50% lower than in 2022. The market has been indirectly supported by social housing bodies, which have purchased or reserved housing on a massive scale, but with negative or zero margins for developers.

And the situation is set to continue. Between September 2022 and August 2023, fewer than 380,000 homes were authorised for construction, i.e. 147,000 fewer than in the previous twelve months (-28%) and 17% fewer than in the twelve months preceding the health crisis.

As a direct consequence, the stock of new properties on the market will continue to fall. This could indirectly support sales of older homes. On the other hand, the slowdown in sales of existing properties is significantly increasing the stock of properties for sale.

A proportion of property production by developers is for rental investment. And here too the climate is gloomy. With interest rates rising, landlords might be hoping for an increase in rents. However, rents remain low, even if they may seem too high for tenants, given the cap on rents and the rent increase index. As a result, risk-free financial investments occasionally offer better returns than riskier rental investments.

We will also have to wait for a fall in interest rates or property prices before investors return to the market in a bigger way.

The property situation is gloomy in the existing, new-build and rental markets: the market will remain very sluggish in 2024 as long as property prices and interest rates have not fallen significantly. It is unlikely that the number of sales of existing properties will exceed one million again.

The new MaPrimRénov'2024 scheme, which gives the most modest households the benefit of very substantial support for major energy renovations, could lead buyers to purchase energy slum properties. The ban on letting these properties will lead many owners to sell them at a substantial discount to better insulated properties. This is undoubtedly an opportunity for first-time buyers, provided they can find the tradesmen to carry out the work.

The market for prestige properties is likely to be less affected, as buyers of these types of property make relatively little use of bank finance. On the other hand, the commercial property market, whether rural or urban, will be directly affected by the cost of bank debt.